Your credit score plays a big role in your financial life, even if you don’t realize it. Whether you want a loan, a credit card, or better interest rates, your credit score matters.

In this article, you’ll learn what a credit score is, why it is important, and easy ways to improve it quickly—even if your score is currently low.

This guide is written in simple, human language, making it easy for beginners to understand.

What Is a Credit Score?

A credit score is a number that shows how well you manage borrowed money. Banks and lenders use this score to decide whether they should trust you with a loan or credit card.

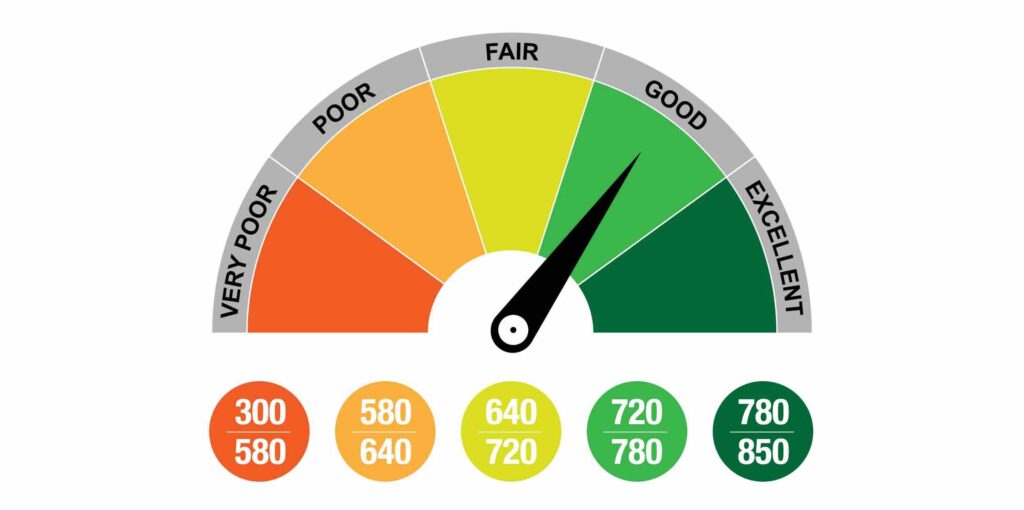

Most credit scores fall between 300 and 850.

- Higher score = better trust

- Lower score = higher risk

In short, your credit score tells lenders how responsible you are with money.

Why Your Credit Score Matters

Your credit score affects more than just loans.

A good credit score helps you:

- Get loans approved faster

- Pay lower interest rates

- Qualify for better credit cards

- Rent homes easily

- Build financial trust

A poor credit score can:

- Cause loan rejections

- Increase interest costs

- Limit your financial options

That’s why improving your credit score should be a top priority.

What Affects Your Credit Score?

Credit bureaus calculate your score using five main factors.

1. Payment History (Most Important)

Paying bills late lowers your score.

2. Credit Usage

Using too much of your credit limit hurts your score.

3. Credit History Length

Older accounts increase trust.

4. Credit Types

Having different types of credit helps.

5. New Credit Applications

Too many applications reduce your score.

How to Improve Your Credit Score Quickly

Improving your credit score does not require magic. You just need smart habits.

1. Always Pay Bills Before Due Date

This is the fastest and safest way to build credit trust.

Tip:

Set automatic payments to avoid missing due dates.

2. Reduce Credit Card Usage

Try to use less than 30% of your total credit limit.

Example:

If your limit is $2,000, keep usage below $600.

Lower usage = higher score.

3. Avoid Multiple Loan Applications

Applying for many loans in a short time makes you look risky.

Only apply when necessary.

4. Keep Old Credit Cards Active

Old accounts show long-term responsibility.

Closing them can lower your score.

5. Check Your Credit Report Regularly

Mistakes happen more often than people think.

Look for:

- Wrong late payments

- Unknown accounts

- Incorrect balances

Dispute errors to get a quick score boost.

6. Clear Small Debts First

Paying off small balances reduces stress and improves your score faster.

7. Use a Secured Credit Card

If your credit is weak or new:

- Deposit a small amount

- Use the card responsibly

- Pay on time

This helps rebuild trust.

8. Become an Authorized User

Being added to a trusted person’s credit card can improve your score quickly—if they pay on time.

Mistakes That Can Damage Your Credit Score

Avoid these common errors:

- Late payments

- Maxing out credit cards

- Closing old accounts

- Ignoring bills

- Applying for too much credit

How Fast Can a Credit Score Improve?

- Minor improvement: 30–45 days

- Noticeable improvement: 2–3 months

- Strong improvement: 6 months or more

Consistency is key.

What Is a Good Credit Score?

Here’s a simple guide:

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800+: Excellent

Aim for 670 or higher for better financial opportunities.

Benefits of Improving Your Credit Score

When your credit score improves, you enjoy:

- Lower loan interest

- Higher approval chances

- Better financial freedom

- Strong money confidence

A good credit score saves money in the long run.

Frequently Asked Questions (FAQs)

Can I improve my credit score without income?

Yes, by paying existing bills on time and controlling credit usage.

Does paying minimum balance help credit score?

Yes, but paying more is better.

Does checking credit score reduce it?

No, checking your own score is safe.

Is zero balance good for credit score?

Yes, but occasional small usage is healthier.

Final Words

Your credit score is not permanent—it can improve with smart actions.

Focus on simple habits like paying bills on time, lowering credit usage, and avoiding unnecessary loans.

Start today, and your future finances will thank you.